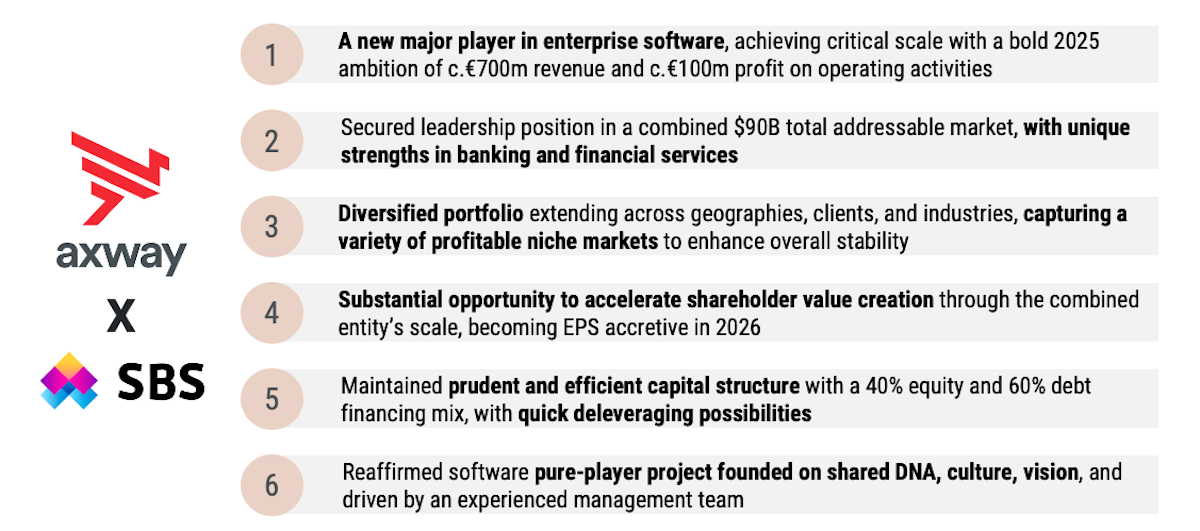

Giving birth to one of France's top enterprise software publisher

Dear shareholder, you will find below a link to the Letter to Shareholders in which the operation and the terms of participation are described:

Access the Letter to Shareholders (French)

Financing a unique development opportunity

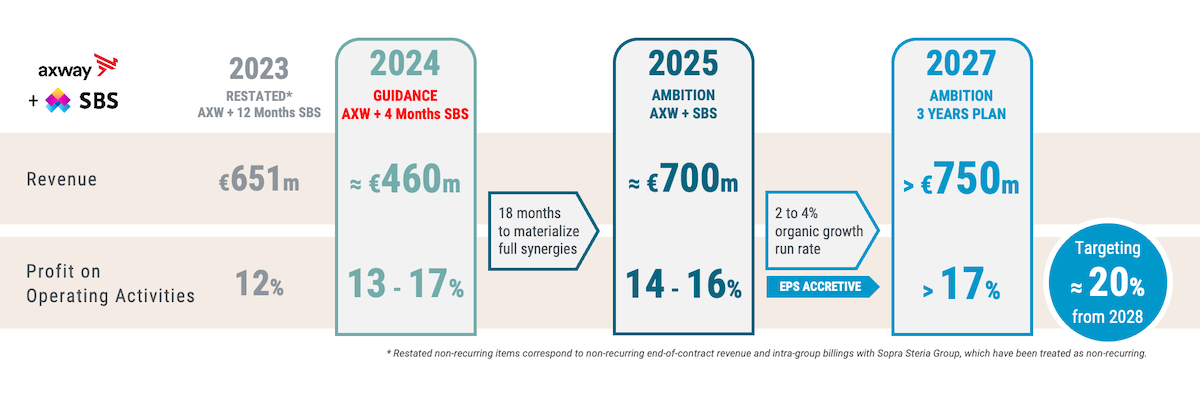

Clear roadmap to strong ambitions

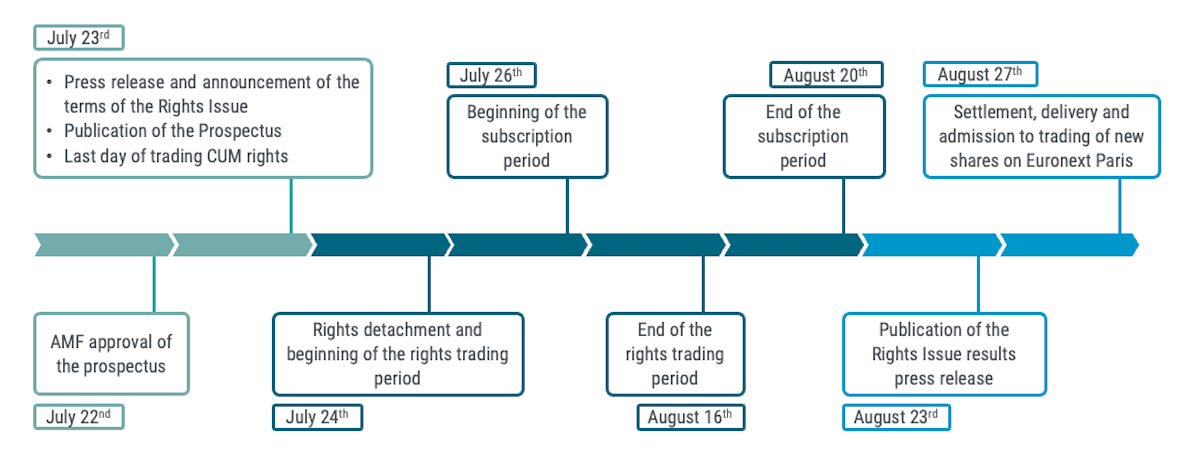

Operation calendar

FAQ

If you are a shareholder, you will receive as many preferential subscription rights as the number of shares you hold in your securities account at the start of the subscription period, your financial intermediary will send you a request for instructions, to be completed and returned.

- If your shares are held in pure registered form, you will receive this request for instructions from Société Générale Securities Services. You must then decide what you wish to do, i.e. either subscribe to the capital increase by exercising all or part of your preferential subscription rights or sell all or part of your preferential subscription rights or do nothing.

- If you are a bearer shareholder, you will receive a request for instructions from your financial intermediary. You will then have to decide what you wish to do, i.e. either subscribe to the capital increase by exercising all or part of your preferential subscription rights, or sell all or part of your preferential subscription rights, or do nothing.

Preferential subscription rights entitle you to Axway shares eligible for the PEA. You can subscribe to new shares using only the cash in your PEA account. They will be delivered to your PEA. If you sell preferential subscription rights in your PEA, the proceeds will be added to the PEA cash account.

The number of preferential subscription rights you hold will be specified on the notice sent to you by your financial intermediary. It is determined on the basis of the number of shares registered in your share account at the end of the day on July 25.

No, preferential subscription rights are a right offered to you. Your investment decision must be based on your objectives and your financial situation. This decision is a personal one. However, if you choose not to sell or exercise them before the deadline indicated by your financial intermediary, they will lapse and lose all value. This is tantamount to losing the economic benefit to which you were entitled.

After August 20, preferential subscription rights will lapse. If you do nothing (neither exercise nor sell), your preferential subscription rights, which will no longer have any value at the end of the subscription period, will automatically disappear from your securities account and will be lost.

The preferential subscription rights will be listed from July 24 to August 16 2024 inclusive. The purchase order for preferential subscription rights is a standard stock market order.

You may only exercise preferential subscription rights in multiples of 8. You can buy preferential subscription rights on the stock exchange to complete your total number of preferential subscription rights and obtain a multiple of 8. You may also sell any surplus preferential subscription rights on the stock market. Fractional preferential subscription rights not exercised or sold will lapse at the end of the subscription period.

It depends on your financial intermediary. You should ask them directly.

Payment must be made on the day of subscription. The amount of your payment must be equal to the total amount of your irreducible and reducible subscription. If the number of shares subscribed for on a reducible basis cannot be fully allocated, the corresponding amount will be reimbursed to you, without interest.

Profits from the sale of preferential subscription rights will be taxed in accordance with the French capital gains tax system, i.e. the capital gain will be subject to a flat rate withholding tax of 30% (including social security contributions at 17.2%, unless the option is exercised to tax income from securities at the progressive income tax rate). The flat tax may be increased by the Contribution Exceptionnelle sur les Hauts Revenus (3% to 4%) depending on the level of reference tax income, i.e. effective taxation at a rate of 33% to 34%, where applicable.

Other Documents

- Press release - Launch of the capital increase

- Fairness opinion FINEXSI

- Amendment to 2023 URD

- Operation note (French)

Subscribe to our mailing list

Sign up to receive our financial press releases